Need to zap some cash across the globe? Chances are, Western Union has popped up on your radar. But before you hit send, it's worth diving deep into the intricate world of Western Union's fee structure. This isn't just about a few dollars and cents; understanding the cost of sending money via Western Union can make a real difference to your bottom line, especially for frequent transfers.

Navigating the landscape of international money transfers can feel like traversing a minefield of hidden charges and fluctuating exchange rates. Western Union, a long-standing giant in the remittance game, offers speed and convenience, but at what price? This exploration aims to demystify the sometimes-opaque world of Western Union fees, empowering you to make informed decisions about your money transfers.

Western Union's history stretches back to the mid-19th century, evolving from a telegraph company to a global financial services behemoth. The ability to send money quickly across borders became a vital service, and Western Union was at the forefront of this revolution. Today, their vast network provides access to financial services for millions, particularly in areas with limited banking infrastructure. However, the convenience comes at a cost, and understanding the pricing structure is crucial for users.

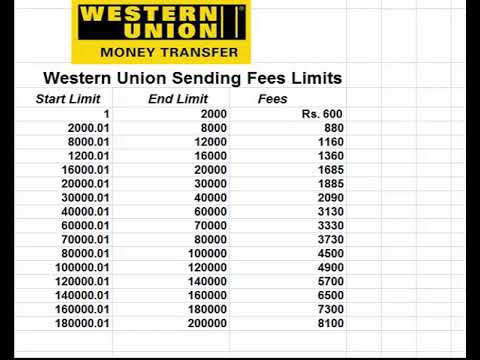

The cost to send money through Western Union isn't a simple flat fee. Several factors influence the final amount you’ll pay, including the destination country, the amount being sent, the payment method (bank account, credit card, cash), and the delivery method (cash pickup, bank transfer). This dynamic pricing model can be confusing, leading some users to inadvertently incur higher fees than anticipated. Transparency is key, and knowing what influences these charges empowers you to optimize your transfers.

For example, sending a small amount to a nearby country might involve a relatively small fee, whereas transferring a larger sum to a more remote location could significantly increase the cost. The method of payment also plays a role. Paying with a credit card might be more convenient but could incur higher charges than using a bank transfer. Deciphering these variables is the first step towards mastering Western Union money transfer fees.

Western Union offers services for individuals and businesses, allowing for money transfers to be sent and received worldwide. The speed and accessibility of their services make them a popular choice for emergencies and situations where quick access to funds is critical.

The fees charged by Western Union contribute to the maintenance of their vast global network of agents and the provision of their money transfer services. These fees cover operational costs, technology infrastructure, regulatory compliance, and profit margins. While the fees can sometimes seem high, they are essential for the company to maintain its operations.

Advantages and Disadvantages of Western Union Fees

| Advantages | Disadvantages |

|---|---|

| Speed and convenience | Potentially high fees compared to other services |

| Global reach and accessibility | Complex fee structure can be confusing |

| Variety of payment and delivery options | Exchange rate markups can impact the final amount received |

One key challenge with Western Union fees is their complexity and lack of transparency. The varying fee structure can make it difficult for users to predict the total cost accurately. A solution is to use Western Union's online fee calculator before initiating a transfer.

Another challenge is the potential for hidden fees, especially relating to exchange rates. Western Union often applies a markup to the mid-market exchange rate, effectively increasing the overall cost of the transfer. Comparing the exchange rate offered by Western Union with the mid-market rate can help you understand the true cost.

Frequently Asked Questions

Q: How much does it cost to send money with Western Union? A: The cost varies depending on the destination, amount, payment method, and delivery method. Use Western Union’s fee calculator for an estimate.

Q: How can I find the cheapest way to send money with Western Union? A: Compare different payment and delivery options, and consider sending larger amounts less frequently to potentially reduce the overall fee percentage.

Q: Are there hidden fees with Western Union? A: Pay attention to the exchange rate offered, as it can differ from the mid-market rate, effectively adding to the transfer cost.

Q: What are the alternatives to Western Union for sending money internationally? A: Online transfer services and some banks offer international money transfers.

Q: How can I track my Western Union transfer? A: Use the tracking number provided to monitor the status of your transfer online or via the Western Union app.

Q: Can I cancel a Western Union transfer? A: Contact Western Union customer service as soon as possible. Cancellations may be possible depending on the status of the transfer.

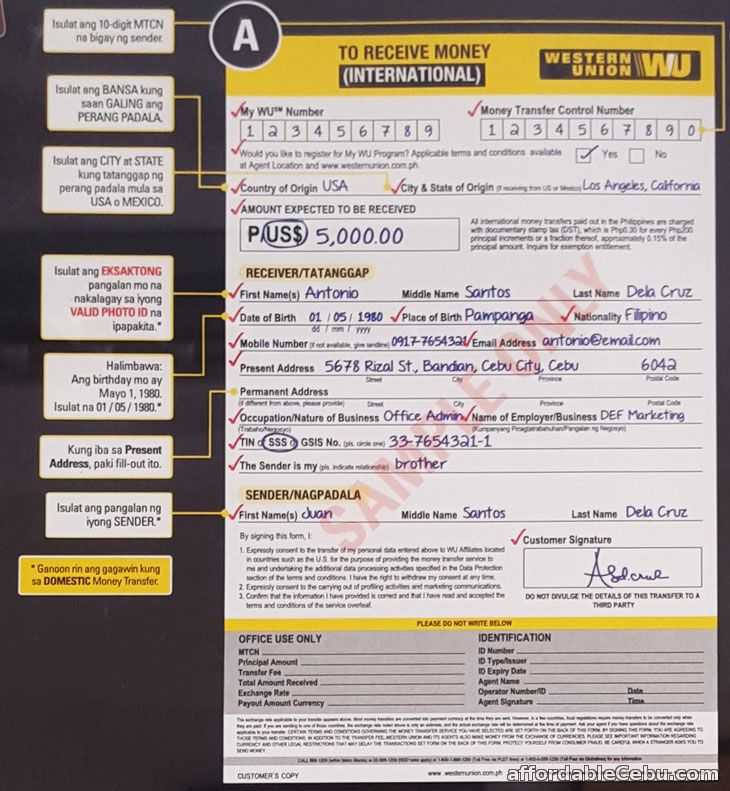

Q: What do I need to send money via Western Union? A: Typically, you'll need the recipient's name, location, and possibly their bank details (for bank transfers). You'll also need your identification.

Q: Is Western Union safe for sending money? A: Western Union has security measures in place to protect transactions, but it's important to be aware of potential scams and only send money to people you trust.

One tip for saving money on Western Union transfer fees is to compare different sending and receiving options. Sending money directly to a bank account might be cheaper than a cash pickup. Another tip is to check for promotional discounts or fee waivers that Western Union occasionally offers.

In conclusion, understanding Western Union money transfer fees is crucial for making informed decisions about your remittances. While the convenience and speed offered by Western Union are undeniably valuable, the cost can vary significantly based on several factors. By carefully considering the destination, amount, payment method, and delivery option, and by comparing the offered exchange rate with the mid-market rate, you can optimize your transfers and potentially save money. Remember to use the online fee calculator and explore alternative transfer services to ensure you're getting the best deal for your international money transfer needs. By educating yourself and taking a proactive approach, you can navigate the world of Western Union fees with confidence and ensure your money goes further. It's about more than just sending money; it's about sending it smartly. This empowers you to take control of your finances and make the most of every transfer. So, next time you're sending money abroad, remember to do your research and choose the option that best suits your needs and budget.

Revitalize your ride the toyota rav4 battery renewal guide

The subtle charm of irish creme sw 7537 exterior

North carolina state employee credit union your financial ally