Ever felt the urge to sever ties with your bank? Maybe you're switching to a credit union, moving abroad, or simply consolidating your finances. Whatever the reason, knowing how to properly close a bank account is crucial. A haphazard approach can lead to headaches, unexpected fees, and even damage to your credit score. This guide dives deep into the art of the bank account closure request, offering a roadmap for a clean break.

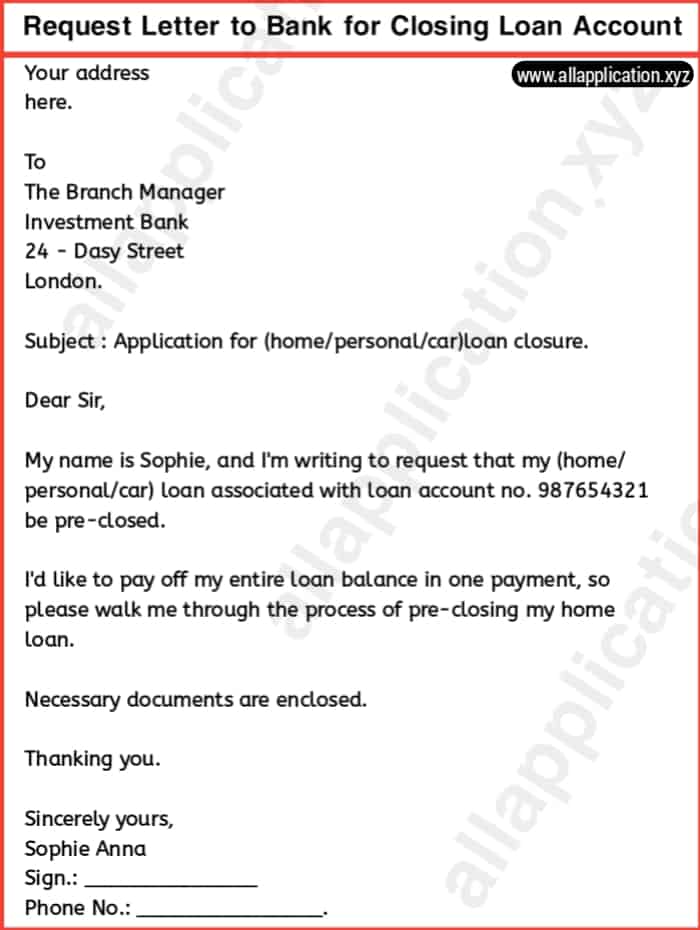

Submitting a formal request to close a bank account isn't just about sending a quick email. It involves a specific process, often initiated with a formal bank account closure letter. This document serves as a clear record of your intention, protecting you from potential future complications. Think of it as the final handshake in your financial relationship with the institution.

The history of closing bank accounts is intertwined with the evolution of banking itself. While the earliest forms of banking didn't involve the same formalized account structures we see today, the need to settle accounts and end financial relationships has always existed. As banking became more structured, so did the procedures for closing accounts. From handwritten letters to modern digital requests, the core principle remains: clear communication is key.

The importance of a formal bank account closure request cannot be overstated. It provides legal proof of your intention to terminate the account, safeguarding you against unauthorized transactions or lingering fees. This written record also simplifies the process for both you and the bank, ensuring a smooth transition.

Common issues related to closing bank accounts often arise from a lack of proper documentation or understanding of the process. Forgetting about automatic payments or outstanding checks can lead to overdraft fees and returned payments. Failing to update linked accounts can disrupt bill payments and other financial services. A well-crafted account termination request helps mitigate these risks.

Closing a bank account involves several steps. First, gather all necessary information, including the account number, routing number, and any outstanding balances. Then, draft a formal bank account closure request letter, clearly stating your intention and providing instructions for transferring any remaining funds. Finally, submit the letter and any required documentation to the bank. Follow up to confirm the closure and ensure all outstanding transactions are processed.

Benefits of a formal closure request include a clear record of your action, protection against unauthorized transactions, and a smoother transition to your new financial arrangements. For example, if a recurring payment attempts to debit your closed account, the formal closure request acts as proof that you are no longer responsible. This can prevent damage to your credit score and avoid unnecessary fees.

A checklist for closing a bank account includes: 1) Verifying any outstanding balances. 2) Setting up a new account if needed. 3) Updating all linked automatic payments and direct deposits. 4) Requesting a written confirmation of the account closure. 5) Destroying old checks and debit cards associated with the closed account.

Advantages and Disadvantages of Formal Account Closure

| Advantages | Disadvantages |

|---|---|

| Clear documentation of account closure. | Requires more effort than an informal request. |

| Protection against unauthorized transactions. | May involve a small processing fee (rare). |

Best Practices: 1) Keep a copy of your closure request. 2) Confirm the closure with the bank. 3) Monitor your account for any unexpected activity after closure. 4) Update your financial records. 5) Properly dispose of old checks and cards.

FAQs: 1) What happens to my remaining balance? 2) Can I close my account online? 3) How long does it take to close an account? 4) What if I have outstanding checks? 5) What if I forget to update a linked account? 6) Can I reopen a closed account? 7) What happens to my online banking access? 8) Will closing an account affect my credit score?

One crucial tip: Always keep a copy of your account closure request for your records. This simple step can save you considerable hassle in the future.

In conclusion, the process of closing a bank account, though seemingly simple, requires careful attention to detail. A formal bank account closure request letter serves as the cornerstone of this process, providing clarity, security, and peace of mind. By understanding the nuances of account termination, following best practices, and being proactive in your communication with the bank, you can ensure a seamless transition and avoid potential pitfalls. Take control of your finances and ensure a smooth transition. Don't underestimate the power of a well-crafted closure request; it's the final step in a responsible financial relationship. This seemingly small act can have significant positive implications for your financial health.

Unlocking high paying trade careers without a degree

Perfect birthday wishes for your older sibling

Unlocking fifa 24 decoding the ultimate team of the year defenders