In the intricate tapestry of personal finance, the concept of "gross household income" emerges as a fundamental thread. It's a figure that whispers volumes about financial health, influencing everything from loan approvals to lifestyle choices. But what exactly does it mean, and why does it hold such significance?

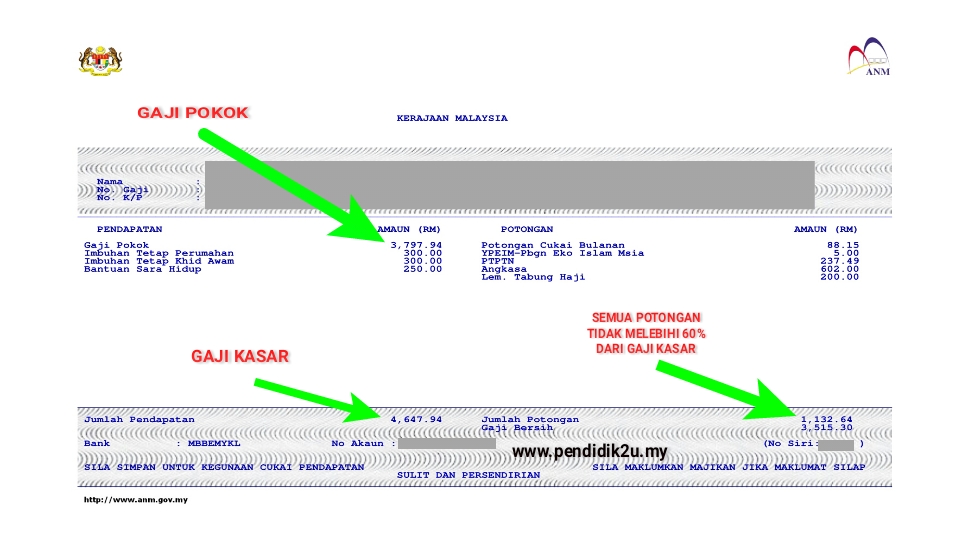

Gross household income, often referred to as gross family income, represents the combined pre-tax earnings of all members of a household. It encompasses all income sources before deductions for taxes, retirement contributions, or other withholdings. Understanding this figure is crucial for navigating the financial landscape, from budgeting and saving to investing and planning for the future.

The history of focusing on household income is intertwined with the development of modern economies and social sciences. As societies transitioned from agrarian to industrial and then information-based economies, understanding income patterns at the household level became increasingly important for policymakers and economists. This allowed for better analysis of consumption trends, poverty levels, and overall economic health.

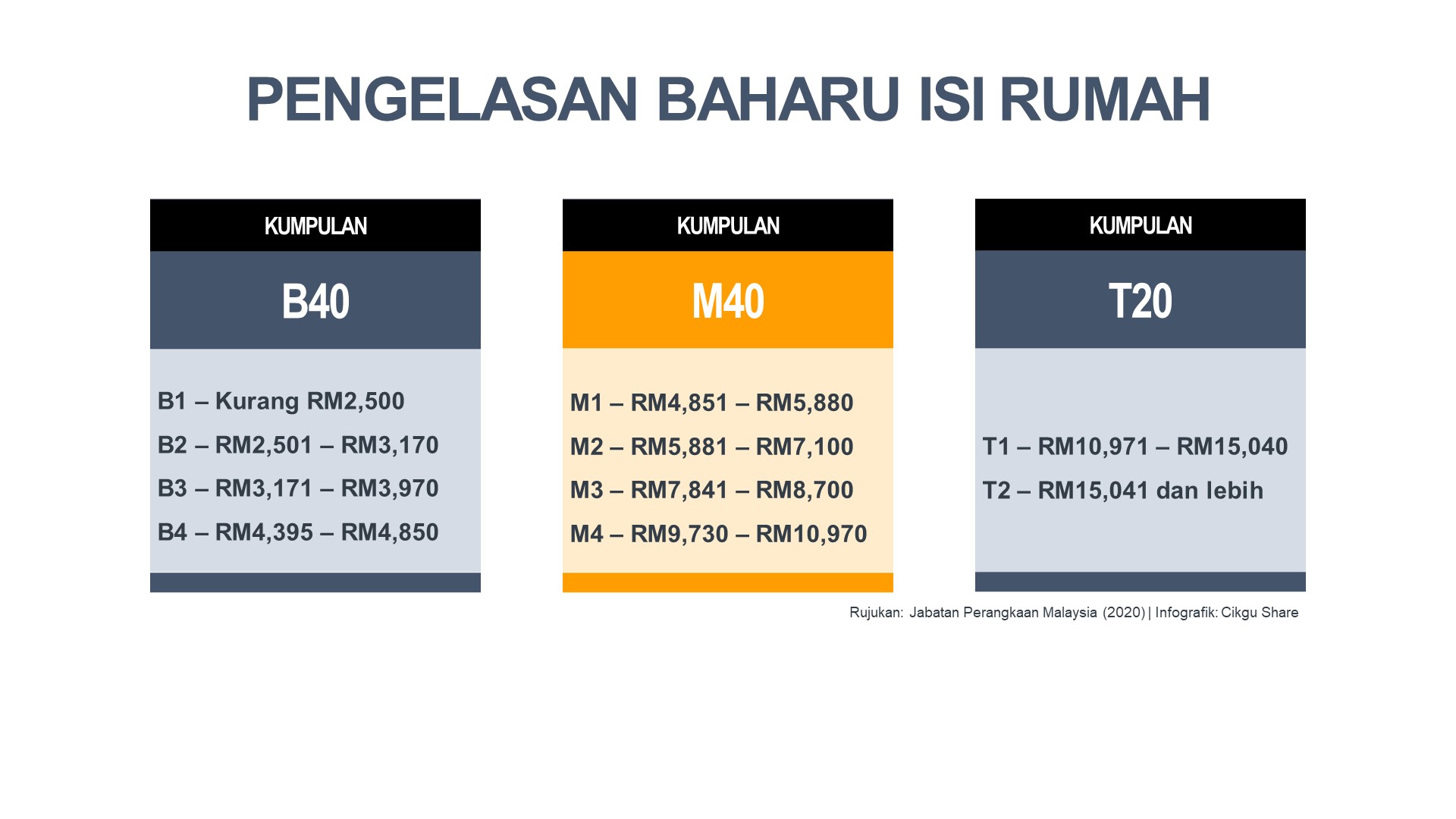

The importance of understanding gross household income extends beyond individual households. It serves as a vital economic indicator, informing government policies, social programs, and market research. By analyzing aggregate household income data, economists can gain insights into income inequality, economic growth, and the overall financial well-being of a population.

One of the key issues related to gross household income is its uneven distribution. Disparities in income levels can contribute to social and economic inequality, highlighting the need for policies and initiatives aimed at promoting economic equity and opportunity. Accurate data on gross household income is essential for designing effective interventions to address these challenges.

Gross household income is calculated by summing up all sources of pre-tax income earned by every member of a household. This includes salaries, wages, bonuses, investment income, rental income, and any other forms of earnings. For example, if a household consists of two individuals earning $60,000 and $40,000 annually, their gross household income is $100,000.

One of the benefits of knowing your gross household income is that it allows for effective budgeting. By understanding your total income, you can create a realistic budget that aligns with your financial goals. Another advantage is that it plays a crucial role in loan applications. Lenders use gross household income to assess your ability to repay borrowed funds. Finally, tracking your gross household income over time can help you identify trends and make informed financial decisions.

An action plan for managing household income can involve setting clear financial goals, creating a detailed budget, tracking income and expenses, and regularly reviewing your financial progress. Successful examples include families who have implemented strategies for reducing debt, increasing savings, and investing for the future.

Advantages and Disadvantages of Focusing on Gross Household Income

| Advantages | Disadvantages |

|---|---|

| Provides a comprehensive view of household resources | Can mask individual income disparities within the household |

| Useful for assessing overall financial stability | Doesn't account for variations in cost of living |

Best practices for managing household income include creating a budget, setting financial goals, tracking expenses, building an emergency fund, and regularly reviewing your financial plan.

Frequently asked questions about gross household income often revolve around how it is calculated, what income sources are included, and its role in loan applications. Understanding these basics is crucial for effective financial planning.

Tips and tricks for managing household income can involve automating savings, negotiating bills, and seeking professional financial advice.

In conclusion, understanding and effectively managing gross household income is paramount for achieving financial well-being. It's a cornerstone of sound financial planning, influencing budgeting, saving, investing, and overall economic stability. By grasping the nuances of this crucial figure, individuals and families can empower themselves to make informed financial decisions, navigate economic challenges, and build a secure financial future. Take the time to assess your household income, create a realistic budget, and implement strategies for maximizing your financial resources. Your future self will thank you for it.

Understanding your car battery voltage

Nutrition ink exploring the singapore tattoo diet trend

Boost your productivity zoom meeting app for pc download guide